The sustainability reporting landscape has recently seen the emergence of high-quality standards with the adoption of the Corporate Sustainability Reporting Directive (CSRD) at the European level and, internationally, with the publication of the International Sustainability Standards Board (ISSB) exposure drafts. These standards attempt to overcome the obstacle of insufficient availability of comparable and reliable sustainability information to support corporate strategy and investment decisions. Many questions then arise to understand how these two standards can work together as some organizations will be subject to both. In this blog, we will unfold what we already know, and identify areas of intersections and key differences. We will see that full interoperability seems unlikely although both the EFRAG (ESRS) and the IFRS Foundation managed to align on major concepts and requirements.

In this article, we will cover the following

- Quick Recap on the CSRD and ISSB

- How do the ISSB and the ESRS Compare?

- What are the main Overlaps between the ISSB Drafts and the ESRS?

- What are the Key Differences between the ISSB Drafts and the ESRS?

- So, How Should We Consider the Interoperability of the ISSB and the ESRS?

- How Can Greenomy Help?

Quick Recap on the CSRD and ISSB

Corporate Sustainability Reporting Directive (CSRD)

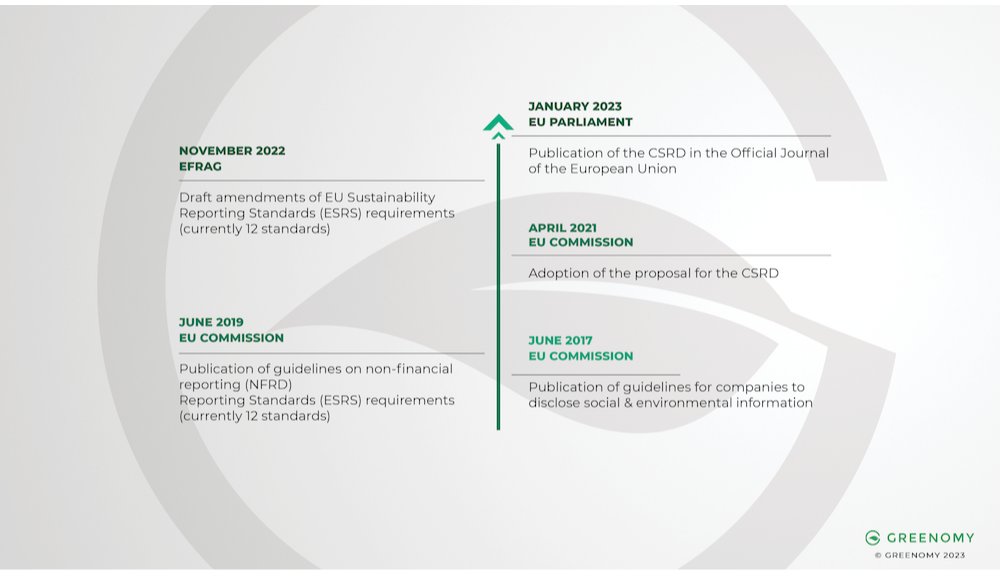

The Corporate Sustainability Reporting Directive (CSRD), was first introduced by the European Commission in 2021. It replaced the Non-Financial Reporting Directive (NFRD), which entered into force in 2014 as the EU's first attempt to standardize ESG reporting. The Directive, which is part of the sustainable finance track of the 2019 EU Green Deal legislative package, was adopted by the EU Parliament in November 2022. Member States will have to transpose it into national law by June 2024 at the latest.

The CSRD strengthens the requirements on sustainability information that companies need to report, as well as expands the scope of the NFRD. To help stakeholders implement the CSRD’s requirements in practice, the EU Commission mandated the European Financial Reporting Advisory Group (EFRAG), a private association, to develop a detailed and mandatory set of disclosure standards, also known as the European Sustainability Reporting Standards (ESRS).

To learn more, read our dedicated articles on the CSRD and the ESRS.

International Sustainability Standards Board (ISSB)

The International Financial Reporting Standards Foundation (IFRS) is a not-for-profit organization well known for issuing ISO and accounting standards for public companies. They are now working to develop international standards for sustainability reporting to inform and support investment decisions.

In 2021, it created the ISSB in an attempt to establish global sustainability disclosure standards as a result of a strong demand to ensure comparable, reliable, and granular sustainability information. A year later, in March 2022, the ISSB published its first two Draft Standards for consultation which are expected to apply from January 2024 (reports due in 2025).

It is worth noting that the ISSB consolidated several existing ESG frameworks such as the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (VRF) while developing its standards.

How do the ISSB and the ESRS Compare?

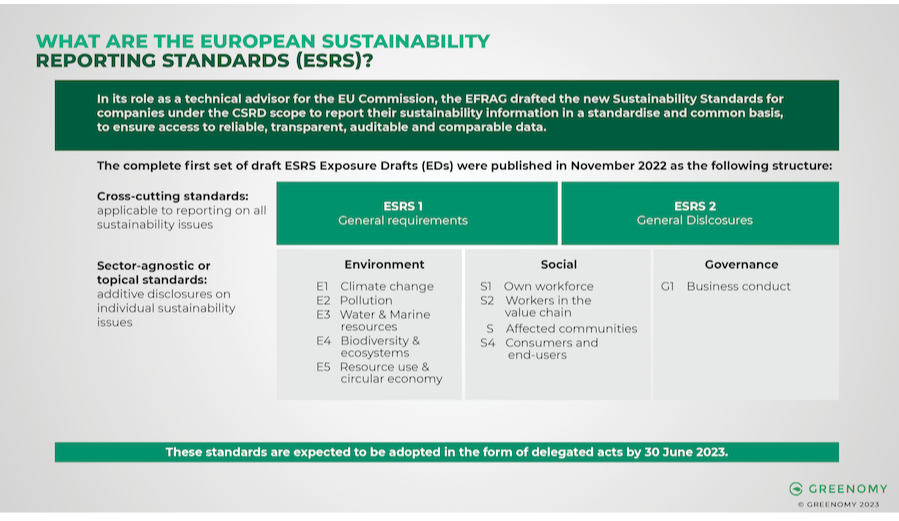

Regarding the ESRS, EFRAG has published a set of 12 draft standards. These drafts contain cross-cutting standards, covering general concepts and requirements (ESRS 1 & ESRS 2), as well as topical standards, covering specific disclosure requirements for a sustainability matter (including environmental, social, and governance matters).

These requirements are quite extensive and detailed as they include, for example, disclosures on the undertakings’ value chains and detailed disaggregation of Scope 3 emissions. EFRAG is also expected to release sector-specific standards in June 2024, as well as standards proportionate to SMEs and non-European undertakings.

Similarly, the ISSB published a first draft setting out general requirements (IFRS S1) and a second draft specific to climate-related disclosures (IFRS S2). Regarding upcoming releases, the ISSB announced that they will seek feedback from investors and market participants on multiple projects. First, on incremental enhancements complementing IFRS S2, and second, on connectivity in reporting by building the Integrated Reporting Framework.

As things stand, it is possible to compare IFRS S1 with ESRS 1 & 2 as well as IFRS S2 with the topical standard related to climate change in the ESRS, ESRS E1 Climate Change.

What are the Main Overlaps Between the ISSB Drafts and the ESRS?

The interoperability between the two standards has been a concern for undertakings and regulators from the start. Both the EFRAG and ISSB have been in constant dialogue during their elaboration to ensure the closest possible alignment and decided to build on the same existing framework in their structure approach.

Both sets of standards use the Task-Force on Climate-Related Financial Disclosures (TCFD) framework and are even going further, by adding more requirements to ensure greater granularity. The TCFD is a task-force created in 2015 by the G20’s Financial Stability Board (FSB) to provide recommendations regarding climate-related disclosures.

IFRS S1 and IFRS S2 fully incorporate the recommendations of the TCFD. The Financial Stability Board (FSB) has requested that these standards take over the Task Force on Climate-related Financial Disclosures' (TCFD) monitoring of the development of companies’ climate-related disclosures.

In addition to that, the EFRAG and ISSB had in-depth interactions with the Global Reporting Initiative (GRI), to ease convergence and facilitate integration for companies that are already using existing standards.

The alignment between the two sets of standards does not only come from using existing frameworks. The ISSB drafts and the ESRS are also aligned on key concepts. Undertakings will now be required to collect information from their value chains. Hence, an alignment on what defines a value chain was seen as necessary.

Moreover, the concept of financial materiality is also aligned (although the ESRS are based on double materiality, see next section) as well as the qualitative characteristics of the requested information. Finally, both standards call for aggregation and disaggregation of information to not obscure material information.

What are the Key Differences Between the ISSB Drafts and the ESRS?

Although the two organizations seek alignment between both sets of standards, there are still differences between them that are important to explain.

Double Materiality vs Financial Materiality

Materiality, in the ISSB drafts, is based on financial materiality. In the ESRS, materiality is based on the concept of double materiality. Although these two concepts overlap, this represents a key difference between the two standards.

Double materiality not only focuses on how sustainability matters affect the development, performance, and position of the company—also known as financial materiality—but also on the impacts of the company on sustainability matters—otherwise known as impact materiality.

In practice, it means that companies mandated to report under the ESRS’ double materiality assessment will be in a position to complete the financial materiality assessment under the ISSB standards in a straightforward manner.

The scope of the materiality assessment is also a source of difference between the two standards. Indeed, the entirety of the disclosure requirements under the ISSB drafts is based on the materiality assessment outcome. Under the ESRS, some sustainability matters and disclosure requirements are mandatory regardless of the outcome of the materiality assessment.

Connection to EU Laws in the ESRS

As a product of the EU and a vital component of the CSRD, the ESRS were designed in a way that satisfies numerous EU legal requirements (such as the SFDR, the Benchmark regulation, and Basel Pillar III). This connection to other EU legislation leads to mandatory and additional requirements in the ESRS which may not be found in the ISSB drafts (in their current state).

The ESRS are also expected to answer to the needs of a broader group of stakeholders. The stakeholders that the ESRS caters to include investors, customers, suppliers, employees, local communities, and regulators. In contrast, the ISSB’s primary users are investors, creditors, and lenders to better inform investment decisions. This broader scope of stakeholders also leads to additional requirements in the ESRS.

Climate-Related Disclosures

Regarding climate-related disclosures, all requirements from IFRS S2 can be found in ESRS E1 Climate Change. Besides that, ESRS E1 requires more information and granularity in all four reporting areas (governance, strategy, impact risk and opportunities, metrics and targets). This notably includes information required by the SFDR, EU taxonomy-alignment ratios, more details on GHG emissions, and different use of scenario analysis.

It is worth noting that the ISSB draft already provides industry-specific requirements on climate which are yet to be developed by the EFRAG, with expected release on 30 June 2024.

Voluntary vs Mandatory Disclosures

While the ESRS are based on the CSRD, a directive developed by the EU, the ISSB drafts were developed by an international organization that has no regulatory power. The ESRS are therefore enforceable by nature whereas the ISSB drafts are voluntary. However, one of the missions of the ISSB is to foster consensus among jurisdictions.

Location of Information

Finally, it can also be noted that the ISSB standards provide more freedom regarding the location of information whereas the CSRD prescribes a specific structure within companies’ management reports.

So, How Should We Consider the Interoperability of the ISSB and the ESRS?

Full interoperability between both standards seems unlikely given the specific connections of the ESRS with other EU laws, its inclusiveness of a broader set of stakeholders, and its materiality approach. However, the ISSB and EU bodies are continuously working on improving the interoperability; the EFRAG stated in its cover letter, published along with the draft standards, that the ESRS were designed so that complying with the ESRS will mean complying with the ISSB standards.

In addition, the European Central Bank recently commented on their current interoperability, indicating the following:

The overlapping elements of the two standards display a high level of correspondence, and their alignment is sufficient to ensure that compliance with the ESRS guarantees compliance with ISSB standards.

Should this level of interoperability be confirmed in the official publication of the ESRS and IFRS standards, it would mean that a company having to report under both sets of standards will not have to perform two full exercises. Instead, the company will be able to retrieve equivalent disclosures and overlaps. It would allow greater focus on major differences, in order to avoid duplication of work.

Simplifying ESG Reporting with Greenomy

Greenomy is your AI-driven sustainability reporting platform for CSRD, EU Taxonomy, and all future emerging ESG Standards. Greenomy empowers corporates to measure, disclose and improve their sustainability.

From data collection, thanks to ESG data libraries that seamlessly integrate diverse data sources, to your dedicated AI Sustainability Advisor, Artemis, to navigate best practices from your industry peers and much more, we help you easily achieve ESG compliance. Book a demo to learn more.

.png)